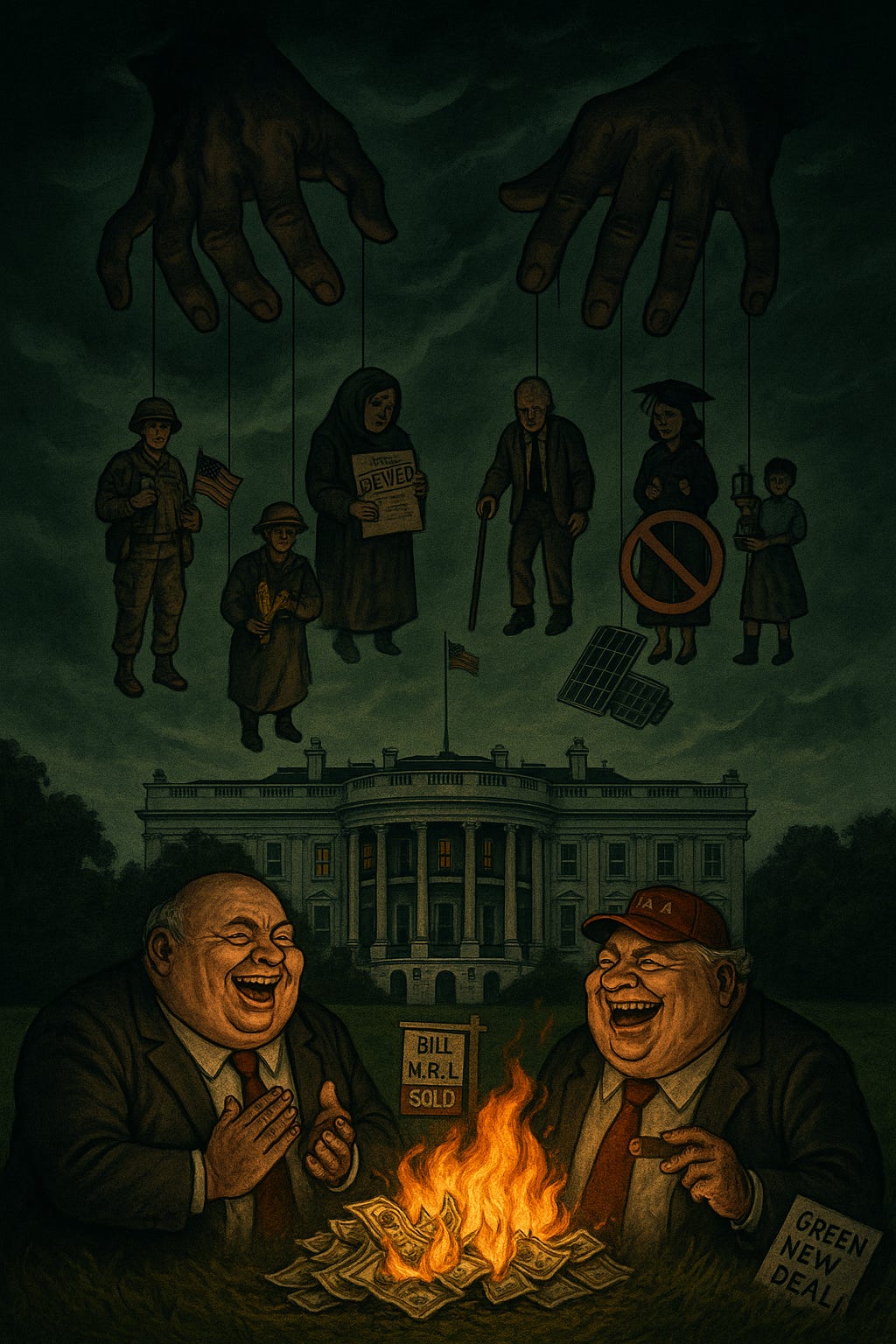

The Big Beautiful Breakdown: Part 1 - The Overview

Trump got his Big Beautiful Bill, what does that mean for YOU?

The bill titled H.R. 1 - An Act to provide for reconciliation pursuant to title II of H. Con. Res. 14 is a massive legislative package with sweeping changes across multiple domains.

This is a brief overview of the main areas affected by this transformative legislation. I will be providing detailed analyses of how these changes will impact Americans in the coming weeks.

This is a sea change for liberty, you cannot afford to not be aware.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

🌽 Agriculture, Nutrition, and Forestry

SNAP Reforms: Tightens work requirements for able-bodied adults, limits internet costs as shelter deductions, and modifies SNAP eligibility for non-citizens.

Food Cost Updates: Locks the “Thrifty Food Plan” (basis for SNAP benefits) to 2021 values, only adjustable for inflation, not reevaluation.

Crop Insurance & Disaster Aid: Expands subsidies and disaster coverage for farmers and ranchers, including a poultry insurance pilot.

Commodity Support: Increases reference prices and marketing loan rates for key crops like wheat, corn, soybeans, and rice.

Dairy & Sugar Programs: Raises payment thresholds and modernizes calculations for these sectors.

🏛️ Defense and Armed Services

Massive Military Investment: Billions allocated to shipbuilding, missile defense, unmanned systems, and hypersonic weapons.

Nuclear Forces Expansion: Funding for new delivery systems, warhead production, and facilities.

Border Security: $1 billion for military deployment at U.S. borders, including temporary migrant detention facilities.

Military Quality of Life: Funds for housing, childcare, tuition assistance, and healthcare for service members.

💵 Tax Provisions

Middle-Class Tax Relief:

No taxes on tips, overtime, and car loan interest.

Enhances the child tax credit and standard deduction.

Business Incentives:

Full expensing of capital investments and R&D.

Boosts credits for manufacturing and family leave.

"Trump Accounts": Introduces new retirement/investment-style accounts with tax benefits.

Ends Green Energy Credits: Repeals nearly all tax incentives for clean energy and electric vehicles.

🛢️ Energy and Environment

Oil & Gas Expansion: Opens new areas for drilling onshore, offshore, and in Alaska.

Green Repeals:

Terminates nearly every major Biden-era clean energy program.

Rescinds funding for EVs, clean buses, emissions reductions, and green federal buildings.

🏥 Health & Welfare

Medicaid & Medicare Overhaul:

Tightens eligibility verification.

Ends some expanded pandemic-era coverage.

Adds community engagement (work) requirements.

Student Loan Changes: Imposes limits on graduate loans, narrows forgiveness programs, and delays recent rule changes on debt cancellation.

Pell Grants: Adds restrictions and introduces “Workforce Pell” for job-related education.

🏠 Housing & Consumer Finance

Cuts Green Housing Programs: Rescinds funds for sustainable retrofits.

Caps CFPB Funding: Cuts Consumer Financial Protection Bureau’s automatic budget authority.

Repeals SEC Reserve Fund: Forces the Securities and Exchange Commission to rely on annual appropriations.

🧾 Immigration and Judiciary

New Immigration Fees: Adds fees for asylum, parole, employment documents, etc.

Boosts Enforcement Funding: Allocates more money for ICE, border facilities, and law enforcement training.

Restricts Refugee Support: Requires vetting for child sponsors.

This bill is broad and complex, combining aggressive tax cuts, military expansion, deregulation, and welfare program restructuring. In the coming weeks I will be breaking down each section of the bill and explaining exactly how it’s going to impact you.